- You can now buy car insurance completely online (or even using an app).

- For those that prefer the traditional way, you can still buy your auto insurance through a local broker.

- There are a variety of discounts available — if you know what to ask for.

- The best way to get cheaper car insurance is to shop around and be willing to switch providers every six-to-twelve months.

Sometimes you really have to follow your own advice if you want to get ahead. For years, I’ve been telling my readers to continually bug their insurance brokers to price out new policies and not just settle for those meager renewal rates. Still, life happens. You get busy with other things. And so, I’ve found myself doing exactly what I say not to — settling. It finally took buying a new house (and being forced to find a new homeowner’s insurance) for me to tell my broker to also price out my car insurance policy. I ended up saving $600 a year! Oh, and I also doubled my coverage. Imagine getting more coverage and saving 20%, just by spending the time to look around for a better deal. Do you want to pay less for your car insurance? Here are some tips for the best way to buy car insurance.

Use a Broker (But Consider Online Options Too)

I’ve used the same car insurance broker for years now because the prices he quotes me are the same as the ones they can get online. The beauty of having an agent is that he can do all the tedious work of sending your information out to various insurance companies for you. The downside is that he may not always send them out to every option out there. I also don’t ask him to send out proposals repeatedly, because he wouldn’t be as helpful if he gets annoyed.

In order to get a better picture of the market, you should also look around for your own quotes from time-to-time. These days, all you have to do is fire up the insurance company’s website, enter some easy to find basic information, and get a quote in minutes. If you find a better deal, then you can tell your broker to match it. If the ones you find are the same, no worries, just go on your merry way and try again in a few weeks. Easy!

Shutterstock

ShutterstockSome Insurance Companies Offer Unlikely Discounts

Many insurance companies offer discounts if you are a member or an employee of certain companies. Some even go a step further and offer special discounts for people whose affiliate with them. Geico, for instance, is part of Warren Buffett’s Berkshire Hathaway. They offer a discount to any shareholder.

My friend got the discount just by telling the agent that he owned the stock. Now there’s no need to lie about it, but the agent didn’t even require proof. He simply acknowledged it and applied a discount. (Unrelated, but it’s a pretty good stock to own).

Shutterstock

ShutterstockDon’t Just Use Whoever Your Friend Uses

Every once in a while, a friend will ask me who I use for car insurance. Soon, everyone is throwing out their own suggestion based on the premiums they pay. However, premiums are priced differently for everyone. They are based on a score of things, including the car you drive, your driving history, and even things like where you live or your credit score. Your insurance company may weigh these things slightly differently than others.

Some companies will penalize more severely for accidents. Others may charge a higher price to insure luxury cars. You won’t know until you price policies out. Unless your circumstances are exactly the same as your friends (same neighborhood, same cars, same driver ages) — which is highly unlikely — your prices and discounts won’t be the same. So don’t just take your pal’s word for it that his insurance company is the best. Sure, it’s a good place to start your search. But don’t sell yourself short.

Shutterstock

ShutterstockShop Around… Constantly

All those factors that car insurance companies use also constantly change, based on real world data. Your situation changes as you age too. That’s why it makes sense to shop around as often as you can handle the legwork. Like I said, I don’t want to annoy my broker by emailing him every week to get new quotes. That would be unreasonable. On the other hand, you should at least be checking into this every year or two.

Not checking at all would be a mistake for your own financial future. So go ahead and do some of the legwork yourself. There’s a good chance it will pay off. After all, I saved myself $600 a year — but only because I was forced to look into my insurance needs by buying a new house. Who knows how many months of savings I had already lost by not checking earlier.

Shutterstock

ShutterstockYou Don’t Have to Wait For Renewal to Switch

Unlike many services where you might prepay premiums, you can switch your car insurance at any time and not lose your money. It’s not a contract. Even if you pre-paid for six or twelve months, you will get a refund for any unused portions if you cancel early. It has to be this way, since many people sell their cars before their insurance renewal rolls around. You can use this to your advantage.

You never have to wait until your renewal month to switch your car insurance. If you find a better deal, you can go ahead and make the switch immediately. Even if you pre-paid for a year only a few weeks ago. Simply call you existing company and tell them you’re cancelling. Even if they do their best to retain you, remember that you’re legally allowed to cancel at any time. Even better, if you paid for a rewards credit card, you’ll probably get to keep the rewards you earned after the insurance company sends you a refund check.ers

Shutterstock

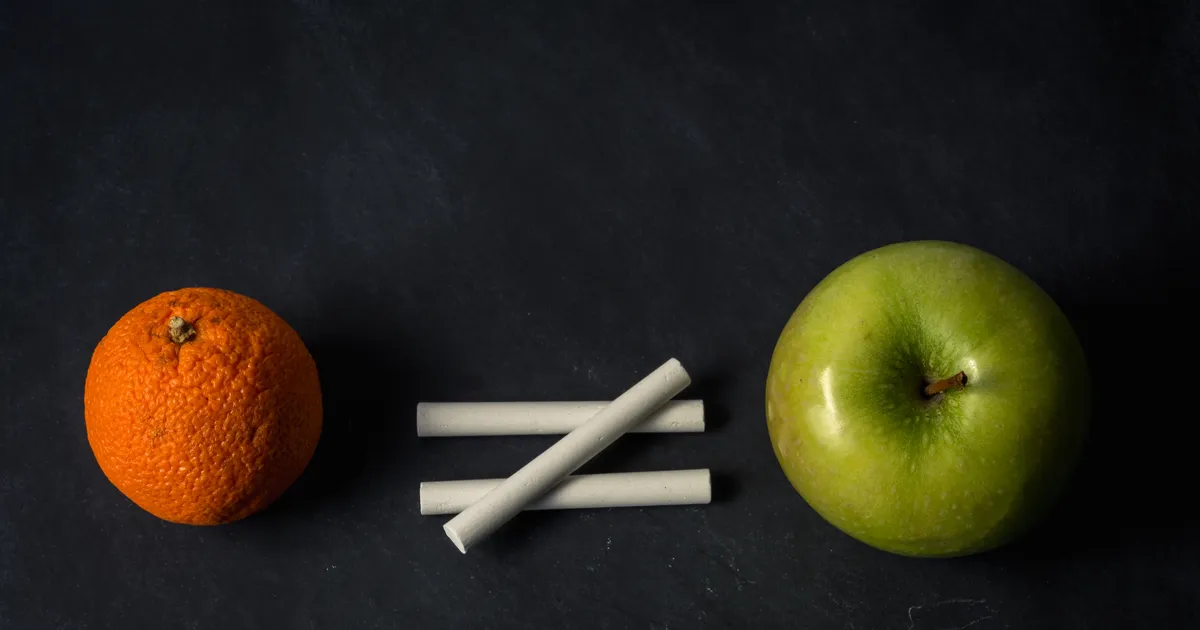

ShutterstockMake Sure To Do An Apples-to-Apples Comparison

This is one area where an insurance brokers can really help. There really are a ton of various insurance options you can choose from. You can customize things like your deductible, comprehensive collision coverage, and even rental car reimbursements. If you’re seeking out multiple quotes, make sure you’re asking about the exact same coverage. Otherwise you can’t shouldn’t be comparing the prices.

Double check on all the information you are giving to these companies. I’m sure you won’t mistake your birthday, but don’t miss any information like your driving record, VINs of your cars, or different associations you are a part of. Sometimes these details matter a great deal. Otherwise, you might find out that what you thought was a great deal is actually just a much worse policy.

Shutterstock

ShutterstockAsk About Discounts

When you communicate with the insurance companies, make sure you ask them all the possible discounts you can get. The popular ones are multi-policy discounts, good driving, or even affiliate discounts. There are some plenty of obvious and not-so-obvious discounts you might be eligible for.

The obvious ones include things like military or senior citizen discounts. I already mentioned about some more obscure ones, like the discount that Geico gives to their shareholders. Some companies also include discounts for first responders, healthcare workers, and students. You never know what might get you some extra savings, unless you ask. Google is often your friend here, so go ahead and do some research.

Shutterstock

ShutterstockFavor Raising Deductibles Versus Lowering Liability Coverage

What should you do if you receive a bunch of quotes and they all come back really high? You might be tempted to lower your coverage. However, that will increase your potential liability. Instead, you should consider increasing your deductible. While you’ll have to pay more out of your own pocket in the event of an accident, at least you’ll still have the same coverage.

It’s always a trade off, of course. You may be worried about being able to afford a higher deductible if something does happen. On the other hand, that deductible will be much cheaper than a potential lawsuit resulting from a major injury caused by an accident. The smartest advice here is to get a deductible that is as high as you can stomach, with it ruining your financially. Whether that’s $500 or $5,000, upping your deductible will lower your premiums.

If you’re really desperate, you can cut other things out too. For example, maybe you have easy access to a backup vehicle (your partner’s or parent’s car, for example) if yours gets damaged in a crash. If you’re not worried about needing a rental car, you can remove that coverage too. It won’t save you a ton, but every little bit helps.

Shutterstock

ShutterstockDon’t Assume You Get the Best Rate With Multi-Policy Discounts

One of the reasons that I didn’t bother to change my car insurance before I moved is because I thought I was getting a good deal by bundling my home insurance together with my vehicle coverage. Turns out I should have looked into things a bit closer. My assumption turned out to be dead wrong, in this case.

Although I was indeed getting a bit of a discount, it could have been so much better. I actually ended up saving even more money by having two different insurance companies insure my house and cars separately. If you had asked me six months ago, I would have (wrongly) told you that wouldn’t happen. Now I know better. Bundling your insurance together can be a great way to save money. However, don’t assume it’s the only way to get the cheapest rates. If you can ultimately save money by spreading your coverage across multiple companies, go for it.

Shutterstock

ShutterstockCheck Insurance Rates Before You Buy a New Car

No one really seems to do this, but really they should. Did you know that a pickup truck worth one-third as much as a sports car actually costs the same to insure in my area? I’m not really sure why, but it’s the truth. Perhaps its because pickups are larger vehicles and likely to do more damage in the event of an accident? Or maybe they are driven much more often than the average sports car. Whatever the reason, pickup drivers aren’t getting any discounts (where I live, at least).

My point is that you should never assume what your insurance will cost when you’re shopping for a new car. The year, make, model, size, and engine power all factor in. Even cars that are stolen more frequently than others will come with a higher insurance premium. So if you’re on a budget, you need to add car insurance rates into your planning when you’re about to buy a new car.

Once you’ve narrowed down your choices to a few vehicles, start calling around for insurance quotes. You may realize one of the choices will cost you much less (or more) to insure. Most people only think about insurance after they enthusiastically drive their shiny new car off the lot. It’s a major buzz kill to later find out that the insurance premiums will cost a small fortune.

Shutterstock

ShutterstockThe Bottom Line

Getting car insurance is pretty easy these days. You can just look for a broker or you can simply go to the car insurance company’s websites to get quotes. There are also plenty of online services that would automatically send quotes out to multiple insurers for you.

That’s why there’s really no reason not to look for better deals more often. There are plenty of ways to save, but they all require you to do a little bit of the legwork. As with most things in life, the more you put in, the more you take out.

Shutterstock

Shutterstock